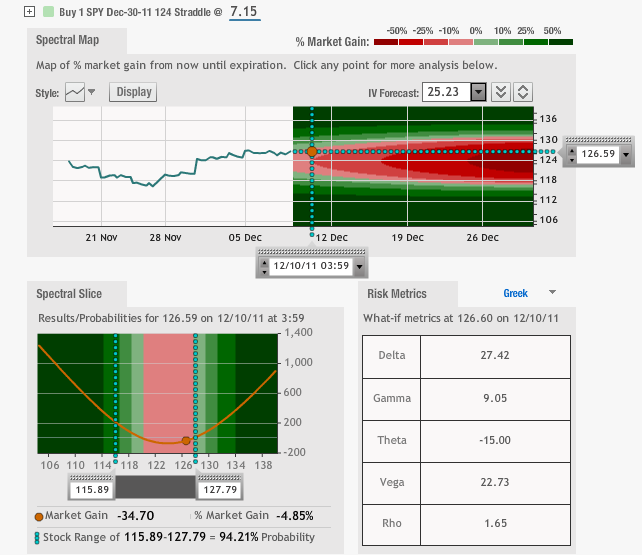

Exactly a week ago, we had initiated a long Straddle position on SPY (Dec Quarterly) with strike price 124. Our original cost was 7.04. The straddle currently has a market value of 7.15 (see above).

Below is a chart of SPY. It has been trading sideways over the past couple of days as traders wait to see the outcome of the Summit: European leaders will meet Thursday and Friday to try to work out a deal to ease the financial crisis.

Since our long straddle position has a high negative “Theta” (please refer to the spectral map and the Greeks table), a sideways move in the market in bad for this trade. However, we are at a juncture where a large move can be expected any time this week. We will closely monitor this position over the next two trading days and, if we do not see any large moves in the market, will roll over this trade to Jan 2012 (as further away expiry date will decrease the loss due to theta in the near term).