On November 28, we took off our hedge (VIX Call spread) and enjoyed a nice rally over the last three trading days. VIX has dropped to 27.75 at the time of writing this post.

Current Thesis:

S&P500 is trading close to the upper end of the trading range we have seen since Aug 2011. Further good news out of EU and good economic numbers here is the US might provide fuel to take the market higher from here. However, situation in the EU is still vulnerable. Also, important payroll number is expected tomorrow morning. I have a feeling that the VIX is cheap at this point, given the drastic market moves we have seen recently.

The Trade:

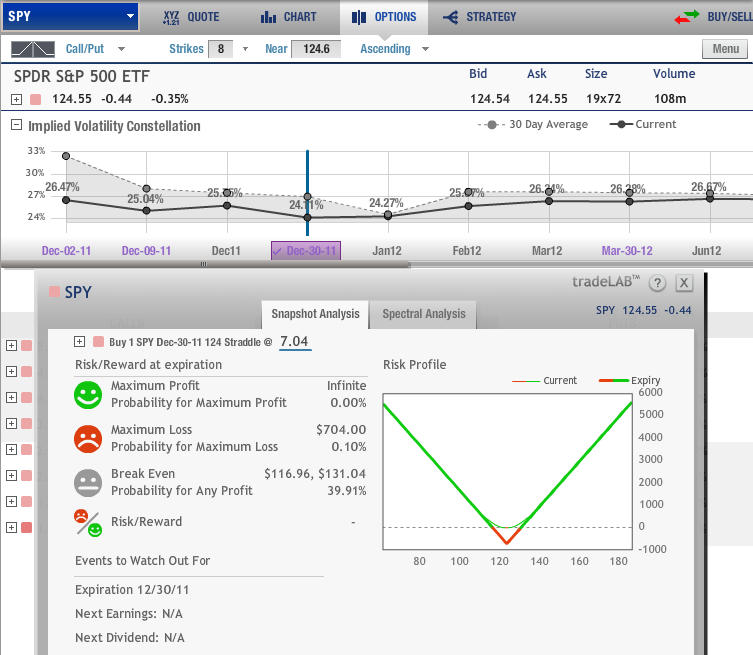

At this stage, I suggest a Long Straddle on SPY with strike price 124.00. The Straddle can be bought for 7.04 (which is the maximum loss associated with the trade). The maximum profit is unlimited. The break-even points are 117 and 131 on SPY by Dec 30.

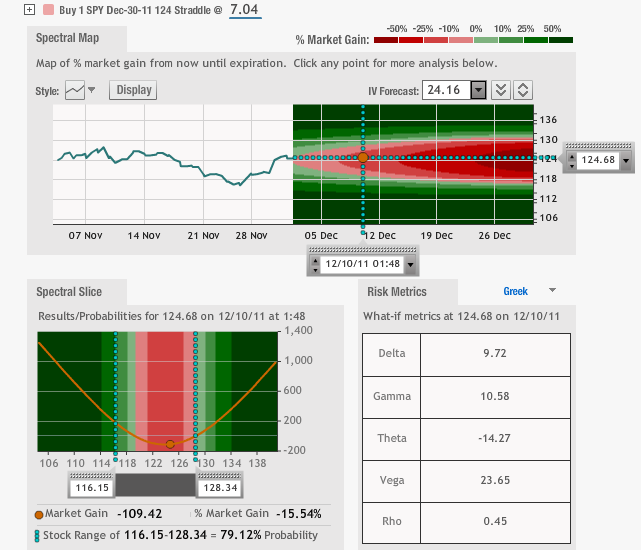

The following spectral analysis depicts that if the market trades flat, this trade will not be profitable as we are long vega. We will closely monitor this trade and will take it off if the value of the straddle falls below 4.50.