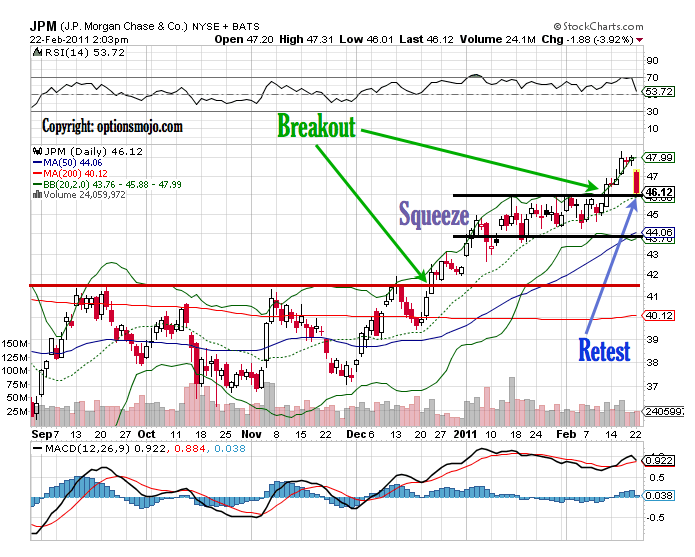

On Feb 11, 2011 JPM broke out of its volatility squeeze and traded up to the 48-range. Today, after ~ 4% correction (along with the broader market due to unrest in Libya), JPM is trading close to the 46-level, the pivot point for the breakout! This also happens to be the place where its 20-day MA resides (45.88 at the time of writing).

On Feb 11, 2011 JPM broke out of its volatility squeeze and traded up to the 48-range. Today, after ~ 4% correction (along with the broader market due to unrest in Libya), JPM is trading close to the 46-level, the pivot point for the breakout! This also happens to be the place where its 20-day MA resides (45.88 at the time of writing).

I think JPM goes higher from here if this 46-level can hold. One can go long JPM at this level, if bullish on the name. But keep an eye on the price action of JPM around this 46-level.

Given the possibility of further correction in the broader market (and hence JPM), if you want a low-risk trade, you can go long the March 46/47.5 Bull Call Spread for ~ 0.67 debit with max potential gain of (1.50-0.67)=0.83 (minus commissions) if JPM trades at or above 47.50 by March expiration. Alternatively, one can go long April 46/49 for 1.20 with max potential profit of 1.80 (minus commissions) if JPM trades at or above 49.00 by April expiration.

great work!

Thank You, Vish…