Dear Everybody!

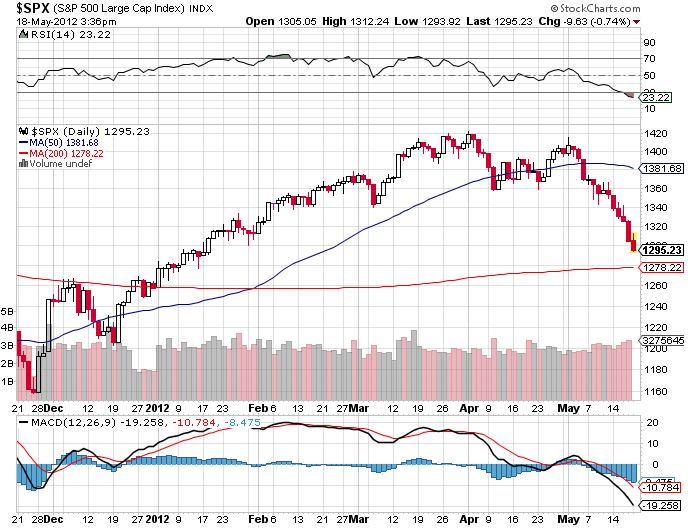

We have benefited a lot from the ~ 13% rise in S&P500 index from the beginning of this year to the beginning of May.

Sell in May and Go Away?

From the intraday high of 1415 on May 01, 2012, S&P500 index has fallen ~ 8.5% so far to 1295 at the time of writing this post. The VIX has rallied more than 55% in the same time period, showing the amount of fear in the marketplace. S&P500 trading down to 1270-1280 range would mark a 10% correction. This is also where the 200-day moving average sits.

We think it might be getting close to the time to start getting long the market again. However, We can not ignore what is going on in the Europe and the slowdown of the recovery here in the US. So we would like to build positions slowly.

Also, even though VIX has rallied more than 55% in the past couple of weeks, we think long positions should be accompanied with put spreads as a hedge.