Event:

Fossil, Inc. (FOSL) is scheduled to report its quarterly earnings before market opens on Tuesday, Feb 14, 2012.

Thesis/View:

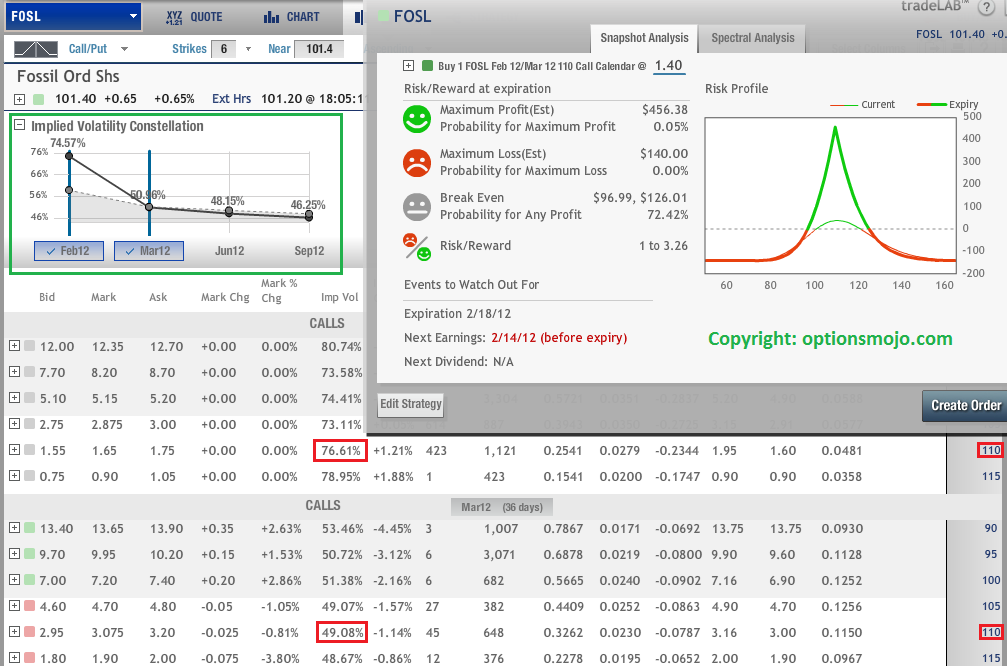

The market is pricing in ~ 8.5% move (one can look at the ATM straddle to calculate the expected move) after FOSL’s earnings release. We are bullish on FOSL’s earnings but do want to take advantage of the elevated implied volatility of FOSL in Feb (~ 77%) compared to March (< 50%). This is a short-term trade.

Trade Structure:

We would like to sell the Feb 110 strike call and buy the March 110 call, thus creating a calendar spread for a net debit of $1.40.

The above plot describes the P/L for the trade. We describe it in more details below.

P/L:

The P/L described in the plot assumes that the long position is also liquidated by Feb expiration. The max loss in this trade is the initial debit of $1.40. The max profit is $4.56, giving the trade a 1 to 3.26 risk/reward. The max profit will be realized if FOSL trades at 110 by Feb expiration.

Further Insight:

We expect the stock to rally after earnings but do not expect it to cross 110 by Feb expiration. That is why we chose the 110 strike. After the post-earnings move is realized, and if FOSL trades below 110 by Feb expiration, an investor can either close all the positions or continue holding the long call position.