Happy New Year Everybody! Wish you all a fantabulous year ahead.

We had a great year in 2011 in terms of trading (even though the S&P500 index closed Flat for the year). Hope we will continue to be profitable in 2012.

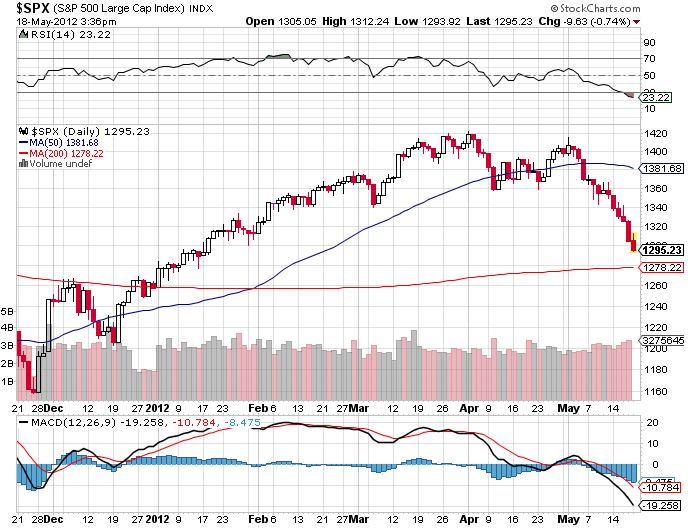

Before I discuss our first trade for 2012, let me discuss my broad outlook. Although I do believe that the US economy is showing signs of sustained recovery and 2012 could be a good year for the market, we have to be careful about situations in Europe and possible weakness in the marketplace due to contagion effects (primarily given the fact that our portfolio is net long).

The following trade makes money if the market rallies, stay flat, or turns south!

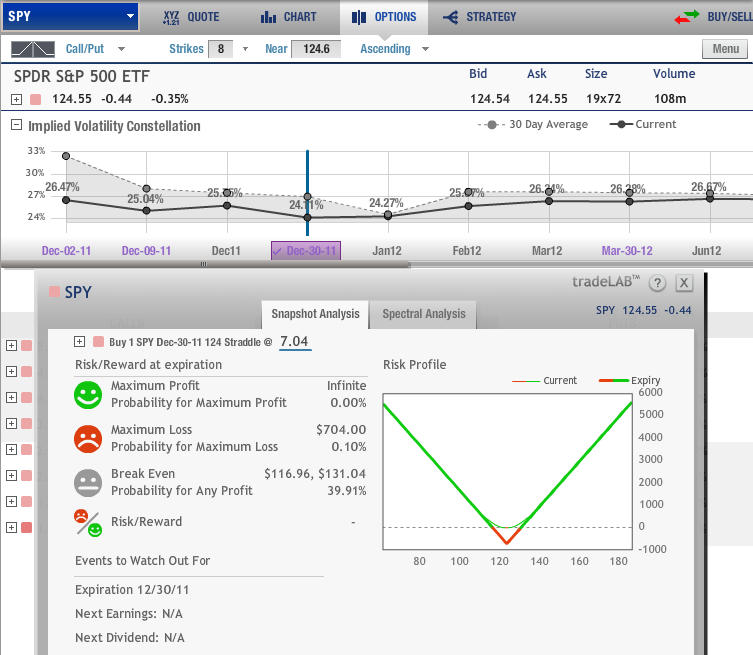

The Trade: I suggest a 120/110 put Ratio (1/2) Spread on SPY expiring on June 29, 2012 (quarterly). We collect a premium of $1.50.

Details of the Structure: Buy 1 Put with Strike price 120. Sell 2 Puts with strike 110.

Profit/Loss:

As you can see from the above P/L analysis, if S&P500 trades flat or rallies from its current level (~1260), and stays above 1200 by June end, we get to keep the $1.50 premium collected.

If S&P500 trades down to 1100, we make our maximum profit of $(120-110)+$1.50 = $11.50. If S&P500 trades below 1100, our profit starts to decrease as we are short 2 puts with K=110. However, we do not lose money until S&P500 reaches 985, which is down more than 20% from the current level. Moreover, if S&P500 trades at 985, I would not mind getting long the market as it would seem pretty cheap at that level. This is a also high probability trade.

Happy Trading in 2012! Good Luck!